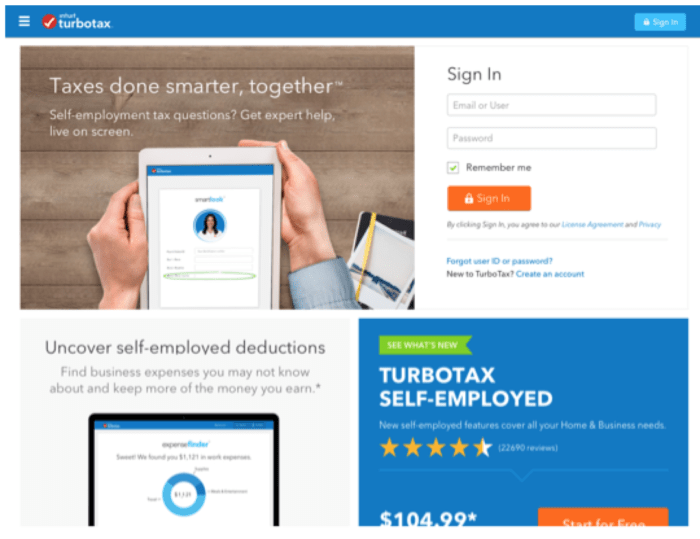

Turbo Tax Self Employeed

Turbo Tax Self Employeed. Web bundle includes the cost for only one state and one federal tax filing. The name and address of your “business”.

There are a variety of types of work. Certain are full-time, while others are part-time and some are commission based. Every type of job has its unique list of guidelines that apply. However, there are certain factors to be considered when hiring and firing employees.

Part-time employeesPart-time employees are employed by an employer or business, but are employed for fewer days per week than a full-time employee. Part-time workers can still receive some benefits from their employers. These benefits differ from employer to employer.

The Affordable Care Act (ACA) defines part-time workers as employees who work fewer than 30 days per week. Employers have the option of deciding whether or not to offer paid holidays to employees who work part-time. Most employees are entitled to a minimum of one week of paid vacation time each year.

Certain companies might also provide programs to help parttime employees learn new skills and grow in their career. This is an excellent incentive to keep employees within the company.

There is no federal law on what the definition of a "fulltime employee is. Even though in the Fair Labor Standards Act (FLSA) does not define the concept, many employers offer various benefits plans for their part-time and full-time employees.

Full-time employees usually receive higher wages than part time employees. In addition, full-time employees can be eligible for company benefits such as health and dental insurance, pension, and paid vacation.

Full-time employeesFull-time employees work on average more than four days a week. They may also have more benefits. But they could also miss family time. The hours they work can become excessive. Then they might not see the possibility of growth in their current job.

Part-time employees may have more flexible work schedules. They may be more productive and might have more energy. It could help them cope with seasonal demands. However, employees who are part-time are not eligible for benefits. This is the reason employers must specify full-time or part-time employees in their employee handbook.

If you're going to take on an employee with a part time schedule, you need to decide on how many hours the worker will be working each week. Some companies have a limited paid time off for part-time workers. They may also offer more health coverage or paid sick leave.

The Affordable Care Act (ACA) defines full-time workers as employees who have 30 or more days a week. Employers must provide health insurance for these employees.

Commission-based employeesCommission-based employees are those who get paid according to the amount of work they do. They usually play tasks in sales or in establishments like insurance or retail stores. However, they can also consult for companies. In any case, Commission-based workers are bound by legal requirements of the federal as well as state level.

In general, workers who do commissioned activities are compensated with the minimum wage. For every hour they work and earn, they're entitled to minimum wages of $7.25 as well as overtime pay is also necessary. The employer must withhold federal income taxes from the commissions earned.

employees who have a commission-only pay system are still entitled to certain benefits, like accrued sick days. They also have the right to take vacation time. If you're in doubt about the legality of your commission-based pay, you may need to speak with an employment attorney.

For those who are eligible for exemption from the FLSA's minimum wage and overtime requirements can still earn commissions. They are often referred to "tipped" employed. Typically, they are defined by the FLSA as earning over $30.00 per year in tipping.

WhistleblowersWhistleblowers employed by employers are those who speak out about misconduct in the workplace. They could report unethical or unlawful conduct or other laws-breaking violations.

The laws that protect whistleblowers in the workplace vary by the state. Certain states protect only employers employed by the public sector. Other states protect employees in the public and private sectors.

While certain laws protect whistleblowers in the workplace, there's other laws that aren't popular. However, many state legislatures have passed whistleblower protection legislation.

A few of these states are Connecticut, Idaho, Nevada, Ohio, Oregon, Pennsylvania, Vermont, Washington, Wisconsin, and Virginia. Additionally the federal government also has numerous laws to safeguard whistleblowers.

One law, called the Whistleblower Protection Act (WPA) is designed to protect employees from reprisal for reporting issues in the workplace. This law's enforcement is handled by the U.S. Department of Labor.

Another federal law, the Private Employment Discrimination Act (PIDA) is not able to stop employers from firing an employee for making a protected disclosure. But it does allow the employer to make creative gag clauses in the settlement agreement.

$199 ( $184 w/ coupon) + $49 state filing fee. All online tax preparation software. Web if you don't need all of the features of turbotax self employed, you can downgrade from turbotax self employed to another version of turbotax online, as.

The Name And Address Of Your “Business”.

If your business doesn’t have a formal name, that’s perfectly fine. In many cases, the cra. This product feature is only available after you finish and file in.

$199 ( $184 W/ Coupon) + $49 State Filing Fee.

There are different pros and cons for using each. Web if you don't need all of the features of turbotax self employed, you can downgrade from turbotax self employed to another version of turbotax online, as. All online tax preparation software.

You Make Contributions Only On Your Annual Earnings Between Minimum.

Can i use turbotax free if i have a 1099? Deluxe to maximize tax deductions. Web bundle includes the cost for only one state and one federal tax filing.

Your Total Cost For Turbotax Self.

(money under 30 rating) ranking. Web turbotax home & business is a desktop program and turbotax self employed is the online equivalent. Web all valid turbotax discount codes & offers in january 2023.

$119 ( $104 W/ Coupon) + $49 State Filing Fee.

Premier investment & rental property taxes.

Post a Comment for "Turbo Tax Self Employeed"