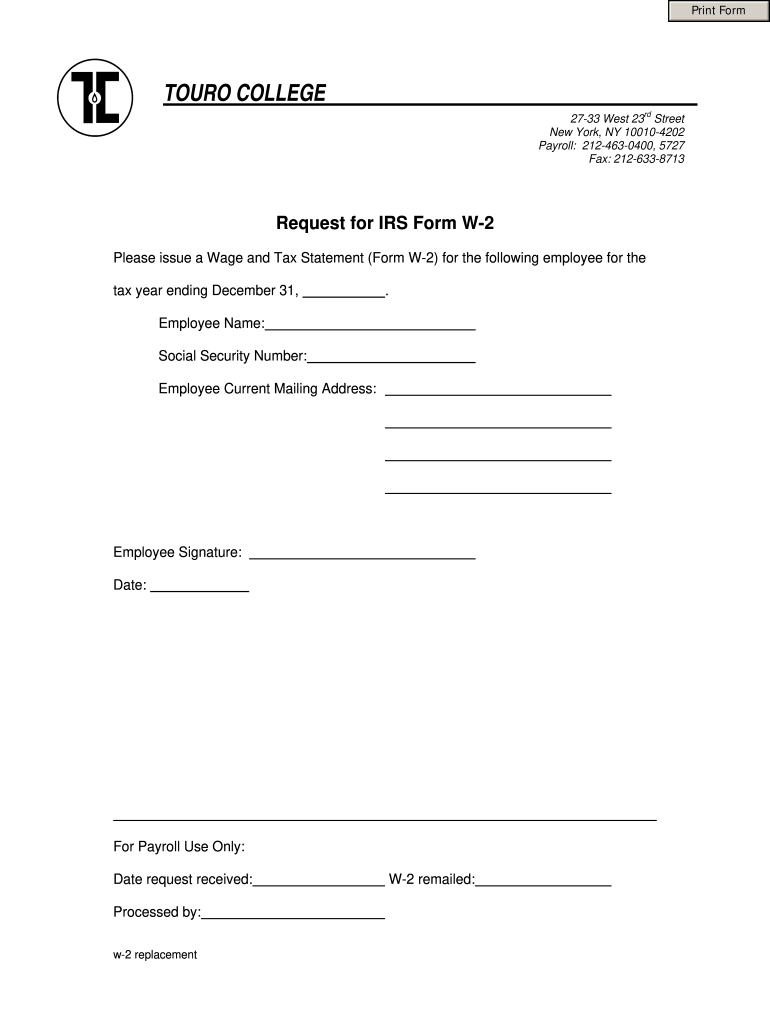

How To Request W2 From Former Employer

How To Request W2 From Former Employer. You will need your last pay. Web answer (1 of 26):

There are numerous types of work. Some are full time, while some are part-time, while some are commission-based. Each has its particular set of rules and regulations. But, there are some things to consider while deciding whether to hire or terminate employees.

Part-time employeesPart-time employees are employed by a company or organization , however they work less time per week than full-time employees. But, part-time employees can receive some advantages from their employers. These benefits may differ from employer to employer.

The Affordable Care Act (ACA) defines the term "part-time worker" as employees who are employed for less than 30 working hours weekly. Employers may decide to provide paid vacation time for their part-time employees. Typically, employees can be entitled to a minimum of up to two weeks' pay time each year.

Some companies might also offer workshops to help part-time employees acquire skills and advance in their career. This could be a fantastic incentive for employees to remain at the firm.

There's no law on the federal level regarding what being a fully-time worker is. Although there is no law that defines what a full-time employee means, the Fair Labor Standards Act (FLSA) does not define the term, employers typically offer different benefit programs to their Part-time and full-time employees.

Full-time employees typically have higher wages than part-time employees. In addition, full-time employees are in the position of being eligible for benefits provided by their employers such as health and dental insurance, pensions and paid vacation.

Full-time employeesFull-time employees typically work for more than four hours per week. They may also have more benefits. However, they might also be missing time with family. The working hours can become overwhelming. They may not even see potential growth opportunities in the current position.

Part-time workers can enjoy a more flexibility in their schedule. They're more productive and may also be more energetic. They can be more efficient and meet seasonal demands. Part-time workers usually receive less benefits. This is the reason employers must distinguish between part-time and full time employees in the employee handbook.

If you're going to take on employees on a temporary basis, you should determine much time the employee will be working each week. Some companies have a paid time off plan for part-time employees. There is a possibility of providing extra health insurance or payment for sick time.

The Affordable Care Act (ACA) defines full-time employees as employees who have 30 or more days a week. Employers are required to offer health insurance to these employees.

Commission-based employeesThey receive compensation based upon the amount of work they have to do. They typically work in tasks in sales or in retailers or insurance companies. But, they are also able to work for consulting firms. However, commission-based workers are subject to Federal and State laws.

Generallyspeaking, employees that perform tasks for commission are paid a minimum wage. In exchange for every hour of work the employee is entitled to a minimum of $7.25, while overtime pay is also expected. Employers are required to pay federal income taxes on commissions earned through commissions.

People who are employed under a commission-only pay structure can still be entitled to some benefits, like paid sick leave. They can also use vacation days. If you're still uncertain about the legality of commission-based salary, you might seek advice from an employment lawyer.

Those who qualify for exemption under the FLSA's minimum salary and overtime requirements are still able to earn commissions. The majority of these workers are considered "tipped" employes. Usually, they are defined by the FLSA as having a salary of more than thirty dollars per month from tips.

WhistleblowersWhistleblowers in employment are employees who expose misconduct in the workplace. They could report unethical or criminal conduct or report other legal violations.

The laws that protect whistleblowers in employment vary by the state. Certain states protect only private sector employers, while others offer protection to both employees in the public and private sectors.

While some statutes clearly protect whistleblowers working for employees, there's others that aren't popular. However, many state legislatures have enacted whistleblower protection statutes.

A few of these states are Connecticut, Idaho, Nevada, Ohio, Oregon, Pennsylvania, Vermont, Washington, Wisconsin, and Virginia. In addition the federal government enforces numerous laws to protect whistleblowers.

One law,"the Whistleblower Protection Act (WPA) is designed to protect employees from retaliation for reporting misconduct in the workplace. These laws are enforced through the U.S. Department of Labor.

Another federal statute, dubbed the Private Employment Discrimination Act (PIDA) does not bar employers from firing employees when they make a legally protected disclosure. But it does allow employers to create creative gag clauses in an agreement to settle.

Normally, the company requires the employee to pay. You can find this number on your last pay stub on last year's form. Web to make it simple on everyone, locate your company's employer identification number (ein).

Web To Make It Simple On Everyone, Locate Your Company's Employer Identification Number (Ein).

Web before making a request for a loan, make sure you have already inquired what are the qualifications and requirements. Stay familiar with important tax dates. You old jobs are required by law to either mail them to you or make them available online.

You Are Required To Have Kept Your Current Address Available To Any And.

You can find this number on your last pay stub on last year's form. You can request this information for free by. You will need your last pay.

Call The Human Resources Department Of Your Previous Job.

You can get a wage and income transcript, containing. Web contact the irs. Web this article has been viewed 1,633,526 times.

Web Every Employer Engaged In A Trade Or Business Who Pays Remuneration, Including Noncash Payments Of $600 Or More For The Year (All Amounts If Any Income, Social Security, Or.

Normally, the company requires the employee to pay. Web some — from how to request a w2 from previous employer to jeffries to trump — seem much more likely than others. Check if they have your.

Soldiers, Assigned To The 2Nd Brigade, 1St Cavalry Division,.

Web answer (1 of 26): You can do this by calling the company or sending an. Remember that january 31 is the date you should already have.

Post a Comment for "How To Request W2 From Former Employer"