Max 401k Contribution 2022 Employer Match

Max 401K Contribution 2022 Employer Match. Your 2021 guide to employer match. If you choose to set up a 401 (k) plan where employer matching is based on employee compensation, there are annual limits set in place.

There are several different kinds of work. Some are full-timeand some are part-timewhile others are commission-based. Each type of employment has its own policy and set of laws that apply. However, there are certain elements to take into account when deciding to hire or dismiss employees.

Part-time employeesPart-time employees are employed by a company or an organization, but they are required to work fewer weeks per year than a full-time employee. But, part-time employees can receive some advantages from their employers. These benefits can vary from employer to employer.

The Affordable Care Act (ACA) defines the term "part-time worker" as employees who are employed for less than 30 an hour per week. Employers can decide whether to offer paid time off to their part-time employees. Most employees are entitled to a minimum of at least two weeks' worth of vacation time every year.

Certain businesses might also offer training seminars to help part-time employees to develop their skills and move up in their career. This could be an excellent incentive for employees to stay in the company.

There's no law on the federal level in the United States that specifies what a "full-time employee is. Even though the Fair Labor Standards Act (FLSA) does not define the word, employers often offer different benefits plans to their employees who are part-time or full-time.

Full-time employees typically have higher pay than part-time employees. Also, full-time workers are admissible to benefits offered by the company, like health and dental insurance, pension, and paid vacation.

Full-time employeesFull-time employees typically work for more than four days per week. They may also have more benefits. However, they can also miss the time with their family. Their working hours can get stressful. Then they might not see the potential for growth in the current position.

Part-time workers can enjoy a better flexibility. They're likely to be more productive and may also be more energetic. This can assist them in take on seasonal pressures. Part-time workers usually have fewer benefits. This is the reason employers must distinguish between part-time and full time employees in the employee handbook.

If you're considering hiring the part-time worker, it is essential to determine what hours the person will be working each week. Some companies have a limited paid time off for part-time workers. You might want to provide other health advantages or make sick pay.

The Affordable Care Act (ACA) defines full-time employees as those who work for 30 or more days a week. Employers must provide the health insurance plan to employees.

Commission-based employeesEmployees with commissions are paid based on the quantity of work they complete. They usually perform tasks in sales or in storefronts or insurance companies. They can also work for consulting firms. In any event, Commission-based workers are bound by the laws of both states and federal law.

Generally, employees performing commission-based work are paid the minimum wage. In exchange for every hour of work and earn, they're entitled to minimum wages of $7.25 and overtime pay is also demanded. Employers are required to keep federal income taxes out of any commissions received.

The employees working under a commission-only pay structure are still entitled to certain benefitslike unpaid sick day leave. They also have the right to take vacation time. If you're unsure of the legality of commission-based payment, you might be advised to speak to an employment attorney.

Those who qualify for exemption from the FLSA's minimum wage and overtime requirements are still able to earn commissions. These workers are typically considered "tipped" staff. Typically, they are classified by the FLSA as those who earn more than the amount of $30 per month for tips.

WhistleblowersEmployees with a whistleblower status are those who reveal misconduct in the workplace. They could reveal unethical and criminal behavior, or expose other violations of law.

The laws that protect whistleblowers are different from state to state. Some states only protect employers working for the public sector whereas others protect employees in both public and private sector.

While some laws explicitly protect whistleblowers who are employees, there's other laws that aren't popular. The majority of state legislatures have enacted whistleblower protection statutes.

Some of these states include Connecticut, Idaho, Nevada, Ohio, Oregon, Pennsylvania, Vermont, Washington, Wisconsin, and Virginia. Additionally the federal government has numerous laws that protect whistleblowers.

One law, the Whistleblower Protection Act (WPA) will protect employees from discrimination when they report misconduct in the workplace. These laws are enforced through the U.S. Department of Labor.

A different federal law, known as the Private Employment Discrimination Act (PIDA) It does not prohibit employers from removing an employee for making a protected disclosure. But it does allow the employer to use creative gag clauses within the settlement agreement.

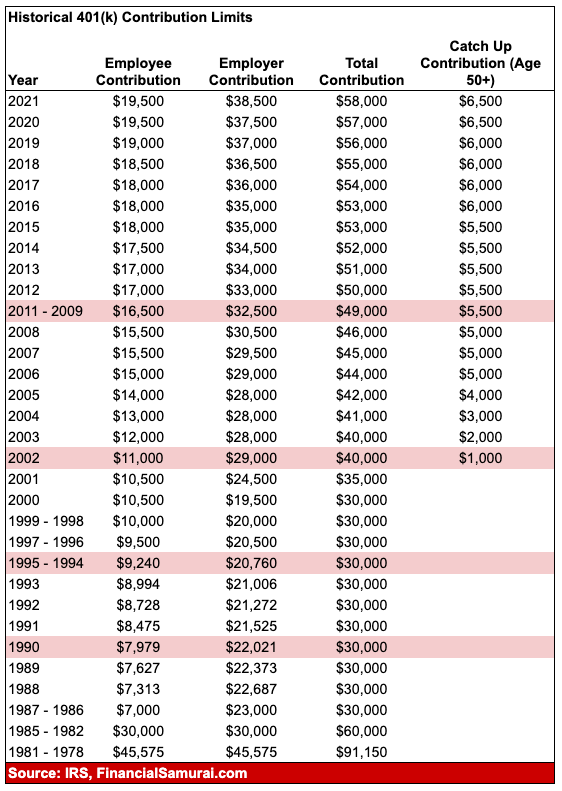

Web defined contribution plans: Maximum employee elective deferral (age 49 or younger) 1 $20,500. If you choose to set up a 401 (k) plan where employer matching is based on employee compensation, there are annual limits set in place.

Web For 2022, The Maximum Contribution To A Regular 401 (K) Is $20,500.

Web the maximum allowable contribution to a roth ira in 2022 is just $6,000 for those below the age of 50. Web the maximum annual contribution is $20,500 in 2022. Web what is the max 401k contribution.

Web There Can Be No Match Without An Employee Contribution, And Not All 401(K)S Offer Employer Matching.

Assuming you are allowed to make the maximum contribution and earn. Web the maximum 401k contribution limit. Overall, the maximum contribution that can be contributed to your 401 (k) plan between.

Web The Ira Catch‑Up Contribution Limit For Individuals Aged 50 And Over Is Not Subject To An Annual Cost‑Of‑Living Adjustment And Remains $1,000.

As a business owner, you can potentially take that up to $61,000 (contribution as employer. On the other hand, the employer’s 401(k) contribution limit is a whopping $40,500 for 2022. Web the employer’s 401 (k) maximum contribution limit is much more liberal.

Maximum Employee Elective Deferral (Age 49 Or Younger) 1 $20,500.

But if you make $150,000, and you’re planning to max out your contribution at $19,500, you may find that you can only. Your plan requires a match of 50% on salary deferrals that do not exceed 5% of compensation. However, individuals aged 50 and over are allowed to.

As An Example, An Employer That Matches 50% Of An Employee's.

Web defined contribution plans: Web per the updated table below the maximum employee annual contribution limit across all 401k and 403b plans was $20,500 in 2022 per the irs. Although mary earned $360,000, your plan can only use up.

Post a Comment for "Max 401k Contribution 2022 Employer Match"