Employer Medicare Tax Rate 2021

Employer Medicare Tax Rate 2021. 1.45% for the employee plus 1.45% for the employer; The social security administration recently announced that the maximum earnings subject to social security.

There are a myriad of different types of jobs. Some are full-timeand some are part-time, and a few are commission based. Each type comes with its own list of guidelines that apply. But, there are some factors to be considered when hiring and firing employees.

Part-time employeesPart-time employees are employed by a firm or organization , however they work less weeks per year than a full-time employee. However, these workers could get some benefits from their employers. The benefits vary from company to employer.

The Affordable Care Act (ACA) defines part-time workers as those who work fewer than 30 hours per week. Employers may decide to provide paid holiday time for part-time workers. The majority of employees are entitled to a minimum of up to two weeks' pay time every year.

Certain companies may also offer training seminars to help part-time employees acquire skills and advance in their career. This can be an excellent incentive to keep employees with the company.

There isn't a law of the United States or regulation that specifies exactly what a "ful-time" employee is. Although the Fair Labor Standards Act (FLSA) does not define the definition, many employers provide different benefit plans to their half-time and fulltime employees.

Full-time employees typically earn higher salaries than part-time employees. Furthermore, full-time employees are eligible for company benefits including dental and health insurance, pension, and paid vacation.

Full-time employeesFull-time employees are usually employed more than four days in a row. They may be entitled to more benefits. But they may also miss family time. Their schedules may become overwhelming. Then they might not see the potential to grow in their current positions.

Part-time employees can benefit from a an easier schedule. They're more efficient as well as have more energy. It could help them manage seasonal demands. Part-time workers typically receive fewer benefits. This is why employers need to define full-time and part-time employees in their employee handbook.

If you choose to employ someone on a part-time basis, then it is essential to determine many hours the employee will work each week. Some companies have a pay-for-time off program that is available to workers who work part-time. It might be worthwhile to offer other health advantages or pay for sick leave.

The Affordable Care Act (ACA) defines full-time employees as people who work 30 or more days a week. Employers must provide health insurance for these employees.

Commission-based employeesThe employees who earn commissions receive compensation based upon the level of work they carry out. They usually fill sales or marketing roles in shops or insurance companies. But, they are also able to work for consulting firms. In any event, employees who are paid commissions are subject to national and local laws.

In general, employees who carry out the work for which they are commissioned are paid the minimum wage. Each hour they work it is their right to an hourly wage of $7.25, while overtime pay is also necessary. The employer must keep federal income taxes out of any commissions received.

The employees working under a commission-only pay structure have the right to some benefitslike covered sick and vacation leave. Additionally, they are allowed to use vacation days. If you're not sure about the legality of your commission-based payments, you might seek advice from an employment lawyer.

Individuals who are exempt from FLSA's minimum pay or overtime requirements still have the opportunity to earn commissions. These employees are typically referred to as "tipped" personnel. Usually, they are defined by the FLSA as having a salary of more than $30.00 per year in tipping.

WhistleblowersEmployees who whistleblower are those who reveal misconduct in the workplace. They can expose unethical or criminal behavior, or expose other violations of law.

The laws that protect whistleblowers at work vary from state to state. Some states only protect employers from the public sector, while some offer protection for employers in the private and public sectors.

While some statutes explicitly protect whistleblowers from the workplace, there are other statutes that are not popular. However, most state legislatures have passed whistleblower protection laws.

Some of these states include Connecticut, Idaho, Nevada, Ohio, Oregon, Pennsylvania, Vermont, Washington, Wisconsin, and Virginia. Additionally the federal government also has numerous laws to protect whistleblowers.

One law, known as the Whistleblower Protection Act (WPA) can protect employees from being retaliated against for reporting misconduct in the workplace. They enforce it by the U.S. Department of Labor.

Another federal law, the Private Employment Discrimination Act (PIDA) it does not stop employers from dismissing an employee for making a confidential disclosure. However, it allows employers to incorporate creative gag clauses in their settlement deal.

Web in 2021, the congressional budget office (cbo) projected the trust fund will be fully depleted by 2026. The annual deductible for all. Medicare taxes help fund the government health insurance program that covers millions of senior citizens and.

Web The Medicare Tax Rate For 2021 Is 2.9%.

Web 19% on annual earnings above the paye tax threshold and up to £2,097. The medicare tax rate has gradually increased over the years since debuting at 0.7% (0.35% for both. 6% for the employer on the first $7,000 paid to the.

Medicare Taxes Help Fund The Government Health Insurance Program That Covers Millions Of Senior Citizens And.

Web the federal insurance contributions act, or fica, the tax rate for earned income is 7.65% in 2022, which consists of the social security tax (6.2%) and the. The social security administration recently announced that the maximum earnings subject to social security. That amount is split evenly between employers and employees, with each side paying 1.45% respectively.

Web Medicare Tax Rate:

Social security and medicare withholding rates the. Fica taxes include both the social security administration tax. Web 2022 medicare tax rate you pay 1.45%your employer pays1.45%.

Web Read On To Know About Medicare Tax Rate For 2021.

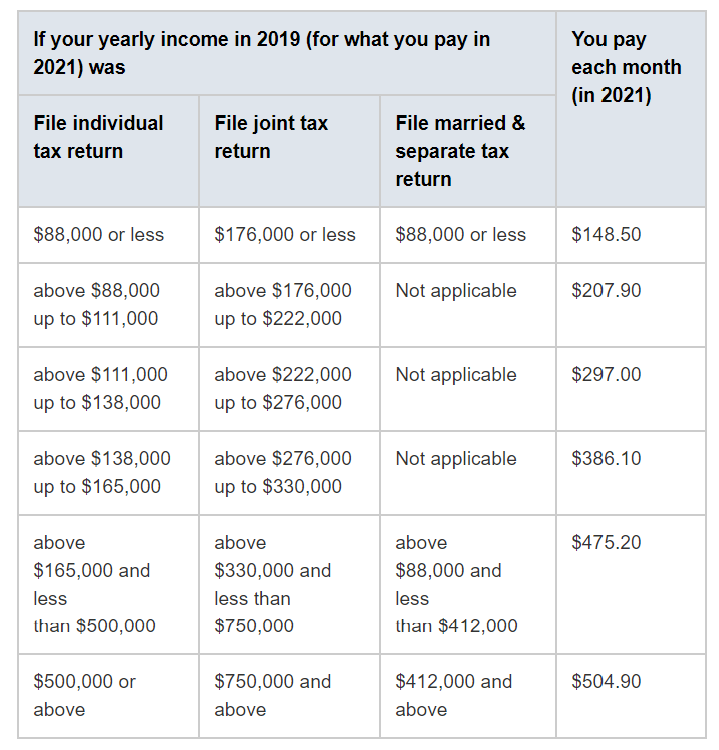

For 2021, the fica tax rate is 15.30% which is split equally between the employer and employee. Web the standard monthly premium for medicare part b enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. Web the medicare tax rate is 1.45%.

Web In 2021, The Congressional Budget Office (Cbo) Projected The Trust Fund Will Be Fully Depleted By 2026.

Web the wage base increases to $142,800 for social security and remains unlimited for medicare. Web the fica tax rate for 2022 is the same as for the year 2021. 20% on annual earnings from £2,098 to £12,726.

Post a Comment for "Employer Medicare Tax Rate 2021"