Fake Pay Stubs And Employment Verification Twitter

Fake Pay Stubs And Employment Verification Twitter. Web fake check stubs with verification can have a variety of negative consequences for both the landlord/banks and the tenant. This is where you can.

There are many different types of employment. Some are full-timeand some are part-time, and some are commission based. Each kind has its own system of regulations and guidelines. There are a few things to consider when hiring and firing employees.

Part-time employeesPart-time employees are employed by a company or business, but are employed for fewer weeks per year than full-time employees. However, these workers could still enjoy some benefits offered by their employers. The benefits offered vary from employer to employer.

The Affordable Care Act (ACA) defines"part-time" workers" as workers that work less than minutes per day. Employers have the choice of whether they will offer paid vacation for part-time workers. In general, employees are entitled to a minimum of an additional two weeks' vacation time each year.

Some companies may also offer programs to help parttime employees gain skills and advance in their career. This can be an excellent incentive for employees to stay at the firm.

There is no federal law that defines what a full-time worker is. While it is true that the Fair Labor Standards Act (FLSA) does not define the term, employers typically offer various benefit plans for half-time and fulltime employees.

Full-time employees typically have higher pay than part-time employees. Furthermore, full-time employees will be legally entitled to benefits of the company, like health and dental insurance, pensions and paid vacation.

Full-time employeesFull-time employees typically work for more than five days per week. They may be entitled to more benefits. But they could also miss family time. Their work schedules could become stressful. Then they might not see the potential to grow in the current position.

Part-time employees can benefit from a more flexibility in their schedule. They can be more productive and could have more energy. This could assist them to fulfill seasonal demands. In reality, part-time workers are not eligible for benefits. This is the reason employers must make clear the distinction between part-time and full-time employees in the employee handbook.

If you're looking to hire an employee on a part-time basis, you need to determine how much time the employee will be working each week. Some companies have a paid time off policy for part-time employees. You might want to provide more health coverage or reimbursement for sick days.

The Affordable Care Act (ACA) defines full-time workers to be those who work or more days a week. Employers must provide health insurance to these employees.

Commission-based employeesEmployees with commissions are compensated based on amount of work they perform. They typically work in tasks in sales or in establishments like insurance or retail stores. They can also work for consulting firms. In any event, working on commissions is governed by legislation both state and federal.

The majority of employees who work on assignments for commissions are compensated with an amount that is a minimum. Each hour they work for, they're entitled an average of $7.25 and overtime pay is also needed. The employer is required to take the federal income tax out of the commissions received.

Employees working with a commission-only pay system are still entitled to certain advantages, such as pay-for sick leaves. They can also make vacations. If you're not certain about the legality of commission-based pay, you may seek advice from an employment attorney.

Who are exempt from FLSA's minimum pay and overtime regulations can still earn commissions. These workers are usually considered "tipped" employee. Typically, they are defined by the FLSA as having a salary of more than $30.00 per year in tipping.

WhistleblowersWhistleblowers in employment are employees who disclose misconduct in the workplace. They could reveal unethical and criminal conduct , or disclose other crimes against the law.

The laws protecting whistleblowers are different from state to the state. Certain states protect only employers from the public sector, while some offer protection for employers in the private and public sectors.

While some statutes explicitly protect employee whistleblowers, there are other laws that aren't as widely known. But, the majority of state legislatures have enacted whistleblower protection statutes.

A few of these states are Connecticut, Idaho, Nevada, Ohio, Oregon, Pennsylvania, Vermont, Washington, Wisconsin, and Virginia. Additionally the federal government is enforcing various laws to safeguard whistleblowers.

One law, called"the Whistleblower Protection Act (WPA) provides protection to employees against discrimination when they report misconduct in the workplace. It is enforced by the U.S. Department of Labor.

Another federal law, known as the Private Employment Discrimination Act (PIDA), does not prevent employers from firing an employee for making a confidential disclosure. However, it allows the employer to use creative gag clauses in the contract of settlement.

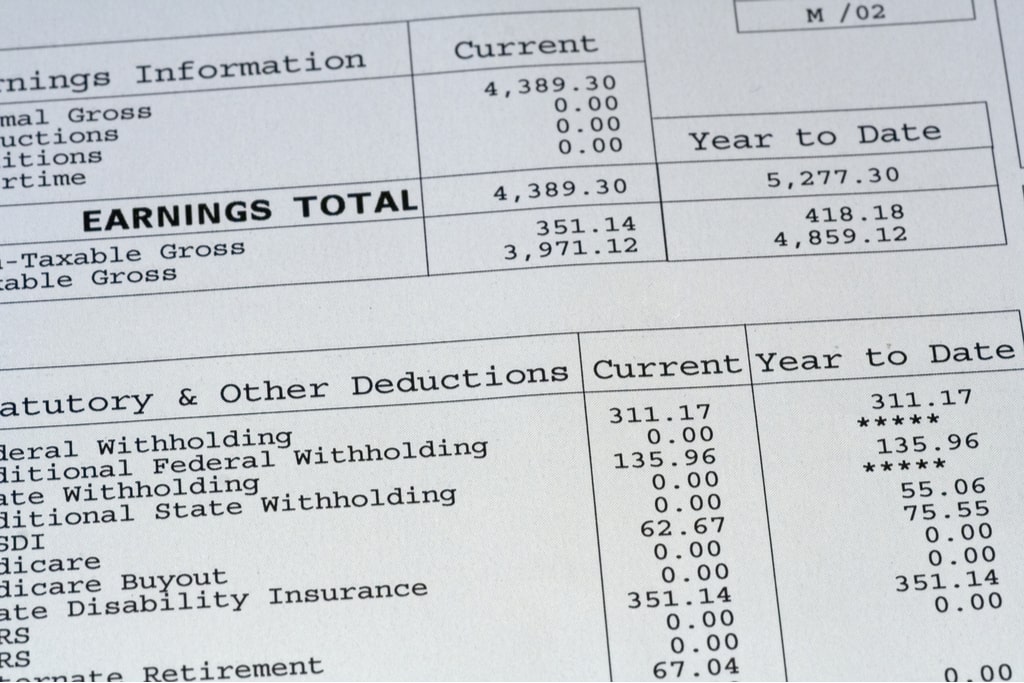

Requesting proof of income is a standard and professional steps in the tenant. Fake employment verification isn’t worth. Web if a major field (such as healthcare insurance, federal taxes, or workers’ comp) is left blank, you can assume it’s a sign that you have a fraudulent stub in your hands.

Web There Are Some Ways To Tell If A Person Uses A Fake Pay Stub.

Pay stubs take a few minutes to create online, making it easier for applicants to create a falsified version. Web search for jobs related to fake pay stubs and employment verification or hire on the world's largest freelancing marketplace with 20m+ jobs. For the landlord, it can mean not getting the full rent.

Fake Employment Verification Isn’t Worth.

Having a process in place to. Web get in touch with the prospective tenant’s place of employment to see if the pay stub is authentic. Web lying about your work history can tarnish your reputation for good, especially in smaller industries where word travels fast.

Web Can You Fake Employment Verification?The Reality Is That Today's Consumers Can Buy Just About Anything On The Internet — Including Fraudulent Income.

Web how to spot a fake pay stub. The employment verification process can help ensure. They are typically very similar to an actual pay stub and.

Web Asking For Multiple Forms Of Proof Of Income Can Help Minimize Your Chances Of Being Scammed.

Web employers can use check stubs with verification to confirm the accuracy of employee payments. Web as mentioned before, a fake pay stub is a document that is used as false proof of income by an applicant. Web document editing service (fake bank statement, fake pay stubs, fake utility bills, fake tax retuns)we can edit any existing document with the details you.

Web Fake Employment Verification Involves Falsifying Information On A Loan, Credit Card, Lease, Or Job Application To Increase The Odds For Approval Or Hire.

Web fake pay stubs: The easiest and best proof of income you never want to see. Web if a major field (such as healthcare insurance, federal taxes, or workers’ comp) is left blank, you can assume it’s a sign that you have a fraudulent stub in your hands.

Post a Comment for "Fake Pay Stubs And Employment Verification Twitter"